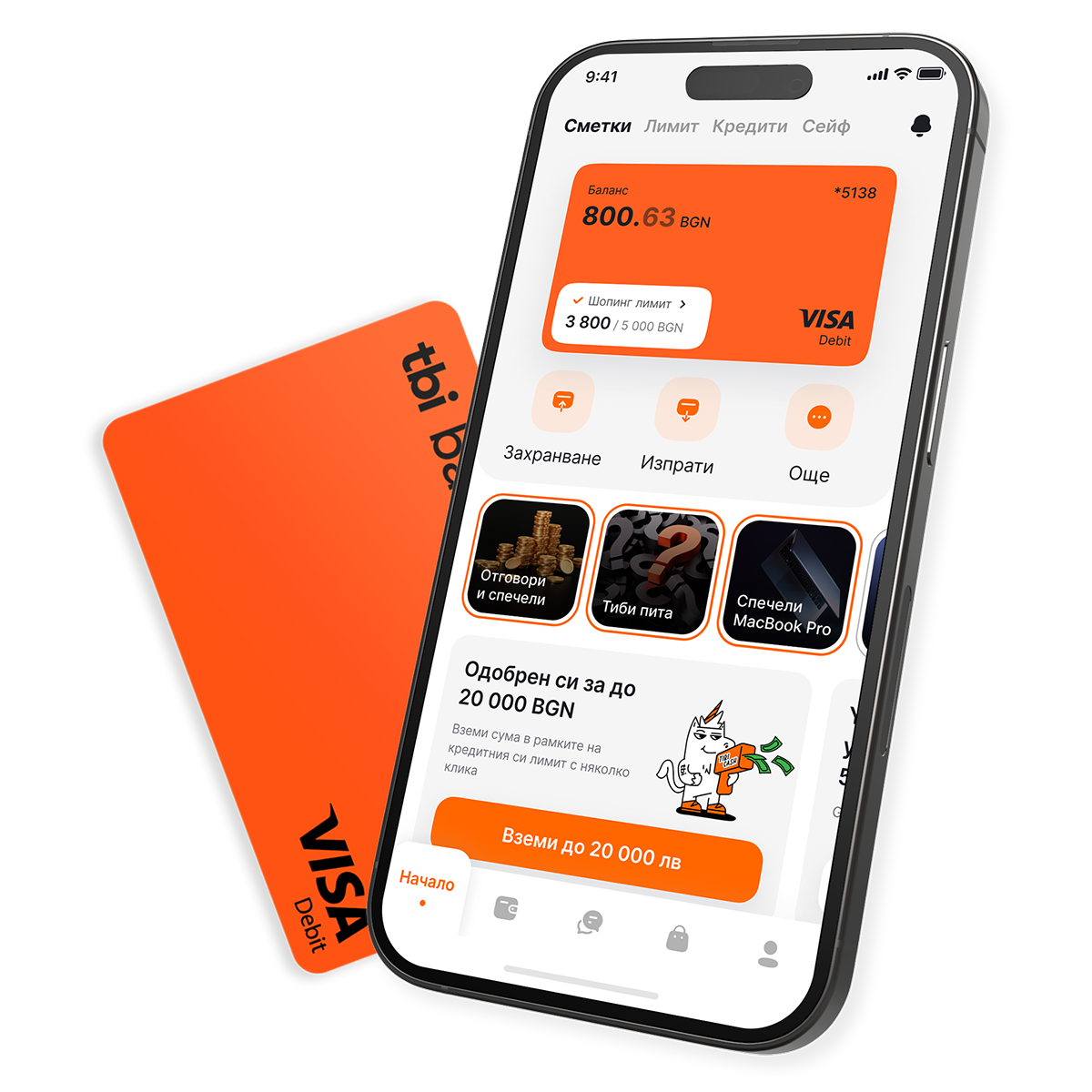

tbi bank в телефона ти

Животът с нас e живот без такси

безплатно откриване и поддръжка на сметки

неограничени безплатни преводи*

плащане на битови сметки без такси

*Преводите през разплащателната сметка, обслужваща платежната карта neon,

в лева за България и евро за единна зона за плащания в евро са без такса.

Нямаш такси, когато имаш neon

безплатно издаване и поддръжка на картата

безплатно теглене от всеки банкомат*

безплатна доставка, където и да си

*Всеки месец получаваш две безплатни тегления от банкомат на стойност до 800 лв.

Вземи допълнителни пари с шопинг лимит до 5 000 лв.

пазарувай с твоя neon и разделяй всяко плащане над 40 лв. на 3, 6 или 12 вноски

ако имаш нужда от пари в брой, изтегли шопинг лимита си на банкомат срещу малка такса

Сметка, която ти носи пари

2.1% годишна лихва по разплащателната ти сметка*

без такси и комисиони

без минимална сума

*За суми до 2 000 лв.

Открий депозит с топ лихва

До 3,0% годишна лихва

+0,2% бонус лихва, когато откриеш депозит през приложението

1 лев или евро минимална сума за откриване

Без такси

Защита на депозити до 196 000 лв.

Банка на download разстояние

Изтегли и отвори tbi bank app

Направи си селфи и няколко снимки на личната карта, за да те регистрираме

Поръчай твоя neon, а ние ще ти го доставим безплатно, където и да си